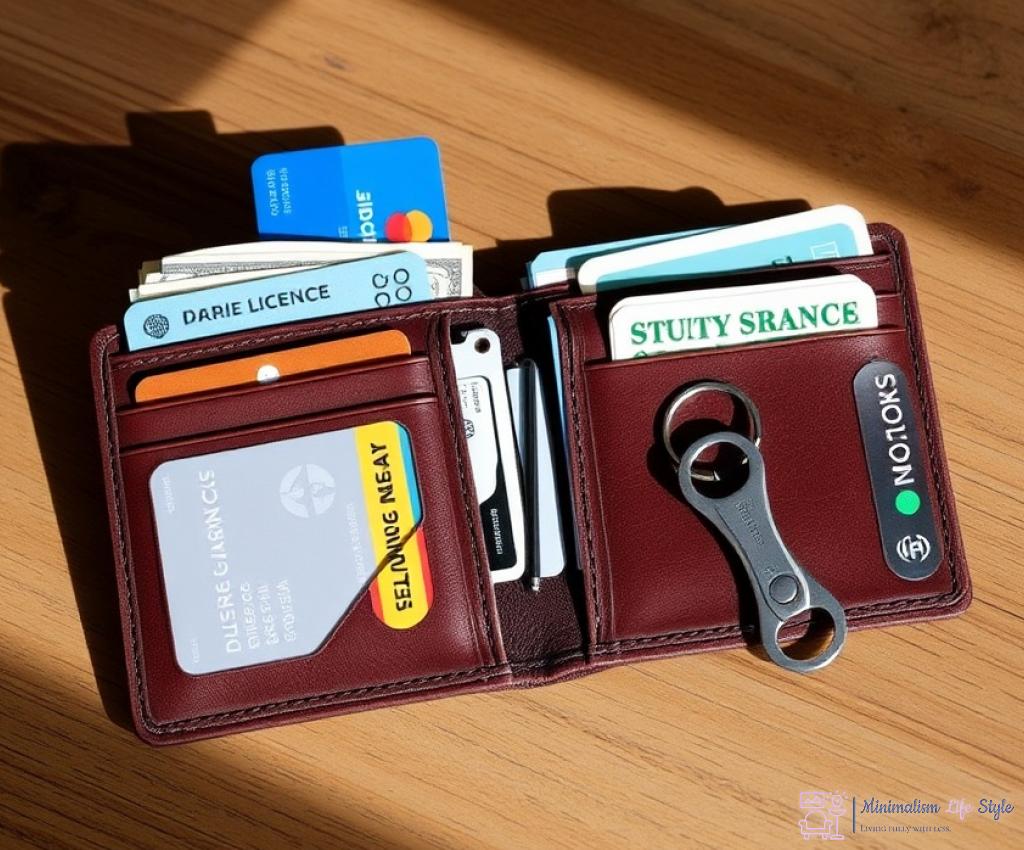

The Essentials: What to Keep in Your Wallet

In a world where less is often more, the contents of your wallet can significantly impact your daily life. A cluttered wallet not only weighs you down physically but can also lead to unnecessary stress and confusion. Embracing a minimalist approach means carrying only what you truly need, allowing for easier organization and greater peace of mind. So, what essentials should you keep in your wallet to achieve this balance?

When deciding what to keep in your wallet, it’s crucial to identify the items that are indispensable to your day-to-day life. The following list outlines the essentials that will help you navigate your daily interactions without the burden of superfluous items:

- Identification: Your driver’s license or state ID is essential for identification purposes.

- Debit/Credit Card: Keep one or two cards for your everyday transactions.

- Health Insurance Card: Important for emergencies, this card ensures that you have access to healthcare when needed.

- Emergency Contact Info: A small note with important phone numbers can be a lifesaver.

- Cash: Always have a small amount of cash for places that don’t accept cards.

While the items listed above are essential, there are also optional items that can be useful depending on your lifestyle. Consider keeping these in your wallet if they apply to you:

- Business Cards: If networking is part of your life, a few cards can be handy.

- Loyalty Cards: Instead of carrying all your loyalty cards, consider using a digital app.

- Membership Cards: Only carry these if you use them frequently.

Ultimately, the goal of decluttering your wallet is to streamline your everyday carry, ensuring that you have what you need without the extra bulk. By focusing on these essentials, you can create a wallet that not only looks good but also makes your daily life easier.

Digital vs. Physical: Embracing Technology for a Lighter Carry

In today’s fast-paced world, where technology is at our fingertips, the traditional wallet is undergoing a transformation. The balance between physical items and digital solutions is crucial for those looking to streamline their everyday carry. This shift not only lightens your load but also simplifies your interactions, making technology an ally in your quest for minimalism.

With the rise of mobile wallets, apps for managing loyalty cards, and digital IDs, the physical contents of your wallet can be significantly reduced. Imagine having all your essential cards stored securely on your smartphone, allowing for quick access and a sleeker profile. Digital tools provide a seamless way to manage your finances and information. For instance, mobile payment solutions like Apple Pay or Google Wallet enable you to make transactions with just a tap, eliminating the need to carry multiple cards. Moreover, many banks now offer digital versions of your debit and credit cards, enabling you to conduct transactions without ever reaching for your wallet.

While embracing technology offers convenience, it’s important to maintain awareness of security. Storing sensitive information digitally requires a strong password and, ideally, two-factor authentication to protect against unauthorized access. A balance must be struck between convenience and security to ensure that your transition to a digital wallet does not compromise your personal information. Furthermore, the potential for battery depletion or loss of your device can pose challenges. Therefore, it’s wise to keep a small stash of cash and a physical ID as a backup, ensuring you are prepared for any situation.

| Aspect | Digital Wallet | Physical Wallet |

|---|---|---|

| Weight | Light as long as the device is charged | Can be bulky with multiple cards |

| Access | Instant access via phone | Requires physically opening the wallet |

| Security | Requires strong passwords and security protocols | Physical theft is a risk |

| Convenience | Easier to manage multiple accounts | Limited to the cards you carry |

As the trend towards digital solutions continues to grow, embracing technology can greatly enhance your minimalist lifestyle. By carefully selecting which items to keep physical and which to transition to digital formats, you can achieve a wallet that not only reflects your values but also simplifies your daily life.

The Art of Card Selection: Prioritizing Your Needs

In the journey towards a minimalist wallet, the selection of cards is a pivotal aspect that cannot be overlooked. With myriad options available, understanding which cards genuinely serve your needs is essential for a streamlined and effective carry. This process not only helps declutter your wallet but also redirects focus towards what truly matters in your everyday transactions.

Before diving into the specifics of card selection, it’s beneficial to take a step back and assess your lifestyle. Consider your daily interactions and the types of transactions you regularly engage in. This reflection will guide you in determining which cards are indispensable versus those that can be left behind. Below is a comprehensive list of card categories to evaluate:

- Payment Cards: Credit and debit cards are fundamental for financial transactions.

- Identification: Ensure you have a valid state ID or driver’s license for identification purposes.

- Health Insurance: Always keep your health insurance card handy for medical emergencies.

- Loyalty Programs: Evaluate if the benefits outweigh the hassle of carrying physical cards.

- Membership Cards: Only retain those that you actively utilize.

Once you have identified your essential cards, the next step is to create a hierarchy based on their importance. Ask yourself the following questions:

- Frequency of Use: How often do I use this card? Cards that are used daily should take precedence.

- Necessity in Emergencies: Does this card provide critical services in times of need?

- Cost-Benefit Analysis: Does this card offer significant rewards or benefits that justify its presence in my wallet?

By answering these questions, you can effectively categorize your cards into three groups: Keep, Consider, and Ditch. This will not only simplify your wallet but will also enhance your overall efficiency in daily transactions.

The ultimate goal of refining your card selection is to transform your wallet experience from cumbersome to effortless. By prioritizing what you truly need, you can navigate through your wallet with ease and confidence. Remember, a minimalist approach is not just about carrying less; it’s about carrying smarter. Embrace this philosophy, and you’ll find that your wallet becomes a reflection of your values and lifestyle, making your daily carry not just lighter, but also more purposeful.

Streamlining Cash: Tips for Minimalist Money Management

In a world increasingly dominated by digital transactions, it’s easy to forget the simplicity and effectiveness of cash. However, maintaining a small amount of cash can not only simplify your financial transactions but also enhance your budgeting skills. By implementing a few strategic practices, you can manage your cash in a way that aligns with a minimalist philosophy, allowing for a more organized and stress-free wallet.

To streamline your cash management, start by allocating specific amounts for different purposes. Divide your cash into categories such as daily expenses, savings, and entertainment. This method not only helps you stay within your budget but also minimizes the temptation to overspend. When each category has a designated amount, you’ll find it easier to track your expenses and make informed decisions about your money. Consider using envelopes or small compartments within your wallet to keep these categories visually distinct. This approach not only keeps your cash organized but also serves as a constant reminder of your financial goals.

Another critical aspect of cash management is to frequently evaluate your cash usage. Take a moment every month to review how much cash you’ve used and for what purposes. This reflection can reveal patterns in your spending habits and help you identify areas where you might be able to reduce cash usage. Perhaps you’ve noticed that certain categories don’t require as much cash as you initially thought, or that you consistently overestimate your need for cash. By adjusting your allocations accordingly, you not only refine your wallet’s contents but also empower yourself to make smarter financial decisions.

Ultimately, applying these minimalist principles to your cash management allows you to embrace a lighter wallet while cultivating better money habits. The integration of cash with a thoughtful approach enhances your overall financial awareness, making your everyday carry an extension of your values and lifestyle.

Regular Maintenance: Keeping Your Wallet Clutter-Free

Maintaining a minimalist wallet is not just a one-time effort; it requires ongoing attention and care. Just as a well-tended garden flourishes, a regularly maintained wallet can enhance your daily experiences by enabling smooth transactions and reducing stress. The goal is to create a habit of routinely assessing and refreshing your wallet’s contents, ensuring it reflects your current lifestyle and needs.

Creating a regular schedule to check your wallet can prevent clutter from building up over time. Consider setting a specific day each month to perform a wallet audit. During this audit, you can assess the necessity of each item, remove outdated cards, and reorganize your essentials. This simple practice not only keeps your wallet streamlined but also allows you to stay in tune with your spending habits and priorities.

One effective method for maintaining a clutter-free wallet is the 30-day rule. This approach encourages you to evaluate whether items in your wallet have been used in the past month. If a card, receipt, or note hasn’t seen the light of day in 30 days, it’s time to consider whether it deserves a spot in your wallet. By applying this rule, you ensure that only the most relevant items remain, promoting a more efficient and lighter carry.

To aid in your wallet organization journey, here’s a concise checklist to follow during your monthly audits:

- Remove Expired Cards: Check for any cards that have expired, such as memberships or insurance cards, and dispose of them appropriately.

- Organize Receipts: Go through any receipts, keeping only those that are necessary for returns or warranty purposes, and store them separately or digitally.

- Reassess Your Cards: Evaluate the cards you carry, asking if each one serves a purpose. Consider switching to digital alternatives for loyalty or membership cards.

- Dispose of Unused Items: If you find items that no longer serve a purpose, such as business cards from networking events that didn’t yield opportunities, let them go.

- Update Emergency Contacts: Regularly verify that your emergency contact information is current and relevant.

By incorporating these maintenance practices into your routine, you can ensure that your wallet remains a reflection of your minimalist values while simplifying your everyday carry. Remember, a light wallet not only makes your daily transactions smoother but also contributes to a clearer mindset.